Beyond Rideshare vs. Dedicated Launches: The Spectrum of Satellite Constellation Deployment Strategies

Looking past the launcher debates: How physics, business, regulation, and market realities shape successful constellation strategies, and what that means for launch companies

The recent SpaceNews article, Rocket Lab CEO Peter Beck depicts dedicated small launch and rideshare as "totally different" markets serving distinct needs. He positions Electron as addressing requirements that SpaceX's rideshare missions cannot meet, stating that "dedicated small launch is a real market, and it should not be confused with rideshare."

This framing perpetuates a false binary in satellite constellation deployment – either choose dedicated launch for precise orbital control and scheduling flexibility, or accept rideshare limitations for cost advantages. The reality is far more nuanced.

Successful constellation deployment exists on a spectrum. Different operators achieve their objectives through varied approaches – some primarily using rideshare, others exclusively with dedicated launches, and many employing mixed strategies. While orbital mechanics imposes constraints, these constraints shape rather than dictate deployment strategies.

By examining how companies like Planet, SpaceX, and others have navigated these choices, we can understand the true factors driving successful constellation architectures. Whether you're a founder, investor, or constellation architect, understanding this spectrum provides a more accurate foundation for strategic decisions than the oversimplified and polarized debate that dominates the launch industry discussion.

Planet Labs: Rideshare as Strategy

Planet Labs demonstrates successful constellation deployment primarily using rideshare launches. Their approach shows how constellation architecture should be driven by fundamental physics, business requirements, and available launch options.

Founded in 2010, Planet achieved "daily imaging of the entire Earth's landmass" by 2017 using primarily rideshare launches – contradicting claims that such approaches lead to decade-long deployment schedules.

Planet recognized optical Earth observation's inherent constraints. Unlike communications constellations requiring multiple orbital planes for simultaneous global coverage, optical satellites only image during daylight hours, making multiple planes less critical. Planet leveraged this by deploying numerous satellites in similar sun-synchronous orbits, achieving daily revisit through satellite density rather than orbital plane diversity.

When dozens of Doves launched on a single mission (like the PSLV-C37 launch with 88 satellites), they used customized deployment mechanisms and passive techniques including differential drag to establish separation without onboard propulsion. This approach aligned perfectly with their business model of providing medium-resolution daily imagery with consistent sun angles.

Planet's success challenges the assertion that rideshare is merely for "technology demonstrations." They've launched hundreds of satellites and refreshed their constellation multiple times through rideshare, demonstrating that deployment strategy depends on constellation type and business requirements rather than absolute claims about rideshare limitations.

While Planet demonstrates success through rideshare, SpaceX's Starlink represents the opposite approach with equally compelling results.

Starlink: The Vertical Integration Advantage by Design

Starlink represents the opposite end of the deployment spectrum, with a strategy shaped by different physics requirements and business objectives than Earth observation constellations.

Communications constellations like Starlink face different constraints. To provide continuous global coverage with low latency, satellites must be distributed across multiple orbital planes to ensure users can simultaneously connect from any point on Earth. This multi-plane requirement is a necessity, not a preference.

SpaceX's deployment strategy directly addresses these requirements: high-volume, dedicated Falcon 9 launches place 50-60 satellites at a time into precise orbital planes. This approach delivers the plane diversity required for global communications coverage while maintaining operational benefits of having satellites in similar planes for network management.

The company's vertical integration creates a unique economic advantage by internalizing launch costs. Their reusability investments further reduce marginal costs, creating a virtuous cycle that makes each launch more cost-effective.

The lesson from Starlink isn't that dedicated launches are inherently superior, but rather that deployment strategy should match the specific constraints and business requirements of each constellation type. For global communications with simultaneous coverage requirements, distributed planes are non-negotiable. For other applications, different deployment approaches may be optimal.

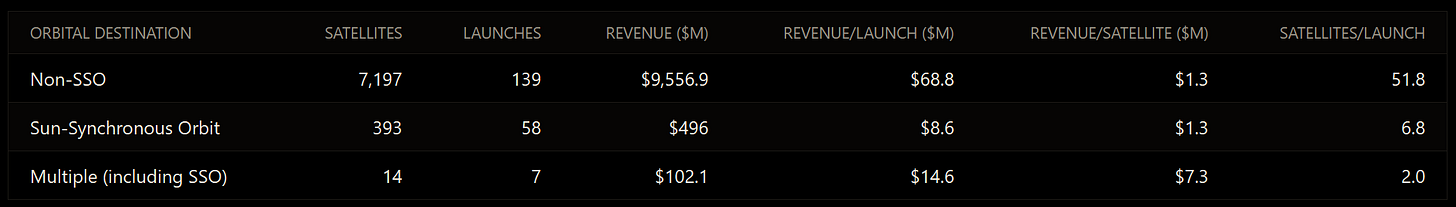

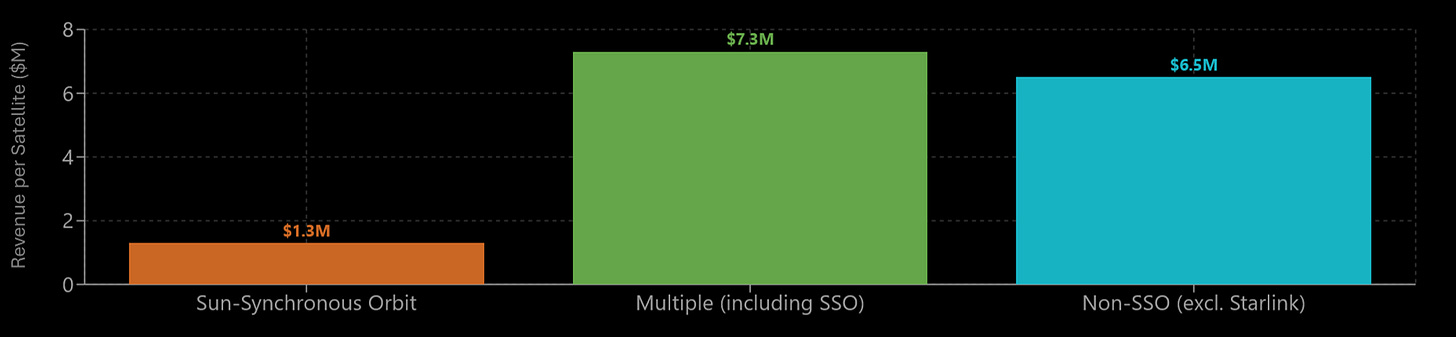

While we use a conceptual approach to most of this commentary, data helps test these perspectives and illuminate market dynamics. However, readers should note this represents only one dimension of the story.

Due to the prevalence of rideshare launches to Sun-Synchronous Orbit (SSO), we can segment this portion of the market, but revenue figures alone don't reveal development costs, operational expenses, or profitability. The categorization shows the diversity of approaches rather than suggesting any single approach is universally superior. There are two items to note: (a) that non-SSO launches contain both dedicated and rideshare (recent SpaceX Bandwagon missions) launches, (b) that any dataset that includes SpaceX or Starlink needs a deeper analysis as its very existence can skew the analysis, and (c) constellation operators utilizing a mix of both types of orbits fall under the third ‘Multiple (including SSO)’ category.

The Middle Path: Blended Approaches

Between these two strategies lies a rich middle ground where companies have blended approaches based on their specific needs.

The above chart is compiled from data taken from publicly available information on satellite constellations operated by various companies1, and provides valuable perspective but requires careful interpretation. Revenue figures without corresponding cost structures can lead to misleading conclusions. What's notable is the distribution of satellites versus revenue across orbital regimes - suggesting different business models can thrive in different segments of the deployment spectrum.

Spire Global exemplifies this with their weather, maritime tracking, and aircraft surveillance constellation. RF signal collection doesn't face the same daylight constraints as optical imaging, but also doesn't require the simultaneous global coverage of communications networks. This positions their requirements between optical Earth observation and global communications.

Spire has built a constellation of over 100 satellites through a combination of launch approaches. For satellites where precise orbital insertion offers significant business advantage, they've used dedicated small launch vehicles. For constellation replenishment or less time-sensitive deployments, they leverage rideshare opportunities. This approach treats launch as a portfolio of options matched to specific mission requirements.

SAR constellations like ICEYE and Capella Space illustrate another interesting case. Unlike optical Earth observation, SAR operates regardless of lighting conditions, potentially benefiting from multiple orbital planes for increased revisit rates. However, SAR data users don't always demand the same global simultaneity as communications networks, creating opportunities for mixed deployment strategies.

HawkEye 360's radio-frequency intelligence satellites further exemplify this principle, using both dedicated launchers and rideshare opportunities, with onboard propulsion for position optimization after deployment.

What's most telling is that operators with viable business models don't wait for "ideal" launch options – they execute with what's available. Economically viable constellations find ways to deploy using available options, adapting their architecture to work within existing economic realities. The fundamental driver remains economics, not technical capability.

Technical Tradeoffs

The rideshare versus dedicated launch debate often oversimplifies the complex engineering decisions that underpin constellation management. Several technical considerations reveal a more nuanced reality:

Orbital mechanics impose constraints for all constellation operators regardless of launch method. While significant inclination changes are prohibitively expensive, sophisticated operators design their architectures with these limitations in mind rather than attempting major post-deployment plane changes. RAAN adjustments through differential nodal precession, often accelerated with modest propulsion, provide flexibility that contradicts the oversimplified "you're stuck where the bus lets you off" characterization of rideshare.

Propulsion capabilities represent another spectrum rather than a binary choice. Almost all operational satellites require some propulsion regardless of launch method, with the degree determined by mission requirements rather than deployment approach. Planet's experience demonstrates that even minimal or no propulsion can support viable constellations when the architecture aligns with natural orbital dynamics.

The responsibility distribution between launcher and operator further challenges simplistic narratives. Launchers—whether dedicated or rideshare—participate only in the initial moments of a satellite's multi-year operational life. The actual "choreography" of maintaining constellation spacing and coverage falls to the operator's flight dynamics management systems, not the launch vehicle that "opened the curtain."

This technical reality explains why we observe successful constellations across the deployment spectrum. Operators make engineering tradeoffs based on their specific mission requirements, balancing propulsion capabilities, orbital insertion precision, and operational flight dynamics to achieve their business objectives within physical and economic constraints.

Regional Opportunities

Understanding constellation deployment as a spectrum reveals significant opportunities for regional launch providers across India, Europe, and the UK. These companies can carve out viable niches by aligning their capabilities with specific market segments, rather than competing directly with established global players.

A launch provider analyzing this data might see opportunities in specific orbital destinations, but should approach with caution. While Non-SSO launches show higher revenue per launch, this doesn't account for development costs, operational complexity, or market saturation. The data invites deeper investigation into why these differences exist and what underlying business models are creating sustainable value in each segment, rather than suggesting a simple path to higher revenues.

Non-SSO orbits are not just resources for LEO communication constellations, they are regimes that have disproportionate regional value for EO/ISR with better economics than SSO for the same data throughput.

For Indian launch startups like Agnikul Cosmos (targeting 100kg to 700km) and Skyroot Aerospace (with variants offering between 290kg and 815kg to various orbits), the opportunity lies in geographic and economic advantages. Operating near the equator provides natural efficiency for certain orbits, while lower development costs can translate to competitive pricing for specific market segments.

Similar opportunities exist across Europe, where emerging launch companies are developing vehicles in various payload classes, focusing on environmental sustainability, responsive capabilities, and specialized orbits that serve regional priorities.

Perhaps the most compelling argument for regional providers extends beyond economics into ‘strategic autonomy’. If geopolitical tensions render US-domiciled providers inaccessible, constellation operators would face limited options. Without regional providers, many would be forced to choose between Chinese launch services—with their own geopolitical complications—or abandoning their plans entirely.

Vehicles in what Peter Beck called the "no man's land" around 1000kg capacity can potentially create value by serving as "mini-rideshare" platforms – offering more customized deployment options than massive rideshare missions while maintaining better economics than smaller dedicated launchers.

Regional launch providers succeed not by claiming universal superiority, but by identifying specific customer segments whose needs align with their capabilities. This strategy requires honest assessment of where their offering creates maximum value, rather than competing in segments dominated by established players with structural advantages.

Strategic Lessons

The landscape of constellation deployment reveals valuable patterns for the industry to consider. Successful operators consistently demonstrate alignment between their deployment approaches and fundamental business priorities. Planet's rideshare-focused strategy matched their capital-efficient growth model, while Starlink's dedicated launch approach aligned with their rapid global deployment objectives. Neither approach was inherently superior – each served its specific business case.

Physics realities clearly shape these decisions. Communications constellations require distributed planes for simultaneous coverage, while Earth observation can achieve coverage through different approaches. The technical necessities of each application influence deployment strategies far more than general claims about launch methods.

Most notably, successful operators remain pragmatic and flexible. They treat launch as an evolving portfolio of options rather than committing to ideological positions about which approach is "best." They adapt to changing market conditions, leverage new opportunities as they emerge, and focus on business outcomes rather than technical purity.

Regulatory frameworks impose strict deployment timelines that fundamentally shape constellation strategies. Under ITU regulations, operators must deploy 10% of their constellation within two years of the initial regulatory period, 50% within five years, and complete deployment within seven years of receiving frequency assignments. Missing these milestones risks losing valuable spectrum rights regardless of business readiness. This regulatory pressure often forces operators to accelerate initial deployments while carefully calibrating subsequent launch cadence to match market demand. Successful constellation operators incorporate these constraints into their launch decisions, treating regulatory timelines as equally important as physics constraints and business requirements when determining their position on the deployment spectrum.

Timeline considerations create tension between regulatory requirements and economic sustainability. OneWeb's journey exemplifies this challenge—after deploying 74 satellites, the company faced bankruptcy in 2020 when funding constraints collided with aggressive deployment plans. Successful operators typically deploy rapidly to secure regulatory rights, then calibrate subsequent launch cadence to match market development. This balanced approach avoids both the "slippery slope" of missed regulatory milestones and the "capacity trap" of deploying satellites far ahead of market demand - basically the first iteration of Iridium - positioning each constellation optimally on the deployment timeline spectrum.

Both buyers and service providers should view this data as a starting point for analysis, not a conclusion. The revenue efficiency differences between orbital regimes tell only part of the story. The seemingly lower revenue per satellite for SSO operations may still represent healthy business models when factoring in typically lower development and launch costs for these often smaller satellites. Different stakeholders will find different insights here - satellite developers need to consider cost structures, while operators should focus on sustainable value creation for their specific application and customer base.

What we have are patterns and they suggest that the most interesting opportunities may exist at the intersections – where innovative constellation architectures meet evolving launch capabilities. As new launch providers add new options to the ecosystem and satellite technologies advance, these intersections will continue to expand.

Conclusion: Breaking the Binary

The choice between rideshare and dedicated launch represents a false dichotomy that doesn't reflect industry reality. What we observe instead is a customer journey where constellation operators make strategic choices based on their specific phase of development, business requirements, and physics constraints.

Planet's successful deployment through rideshare, Starlink's vertical integration advantage, and the mixed approaches of companies like Spire and HawkEye 360 all demonstrate that constellation deployment exists across a spectrum rather than as a binary choice. In many cases, operators begin with rideshare for initial satellites and pathfinders, then evolve their approach as their constellation and business mature.

This perspective provides a more accurate foundation for evaluating both constellation business models and launch vehicle opportunities. For regional launch providers across India, Europe, and the UK, success will come not from marketing against rideshare, but from identifying specific segments within this spectrum where their capabilities create unique value.

The evolution of the launch industry will likely continue to blur these traditional boundaries. Transfer vehicles, propulsive ESPA rings, and other innovations are already creating hybrid deployment options that combine the economics of rideshare with greater orbital flexibility.

By moving beyond simplified binaries and understanding the spectrum of deployment approaches, the industry can foster more accurate technical discussions, develop more nuanced business strategies, and create solutions that address actual needs rather than theoretical constraints. The future belongs to players who recognize this spectrum and position themselves strategically within it, creating new value at the intersections of constellation requirements and launch capabilities.

Space Domain Advisory

The insights in this article reflect the kind of analysis that helps governments, defense agencies, and strategic investors navigate complex space domain decisions. As an independent analyst specializing in multi-domain space strategy, I provide advisory services on:

Orbital regime selection for sovereign capabilities

Launch ecosystem development and investment opportunities

Strategic assessment of constellation architectures

Policy frameworks for emerging space capabilities

I'm opening up a few consulting sessions for teams building in or around the space domain. If that’s something on your radar, grab a time here.