VLEO: The Not-so-Virgin Orbital Regime

Analyzing stealth VLEO capabilities of US, China, Russia, Europe, India and Japan — in the context of commercial VLEO constellations — with custom tools & public data

VLEO isn't new. It's where space exploration was born. Over the decades, space agencies and their scientific missions have systematically explored, exploited, and mastered operating in VLEO for decades. What's new isn't the capability to operate in VLEO, but rather the commercial attempt to transform these hard-won technical achievements into sustainable business models — a challenge that remains unproven despite the marketing hype.

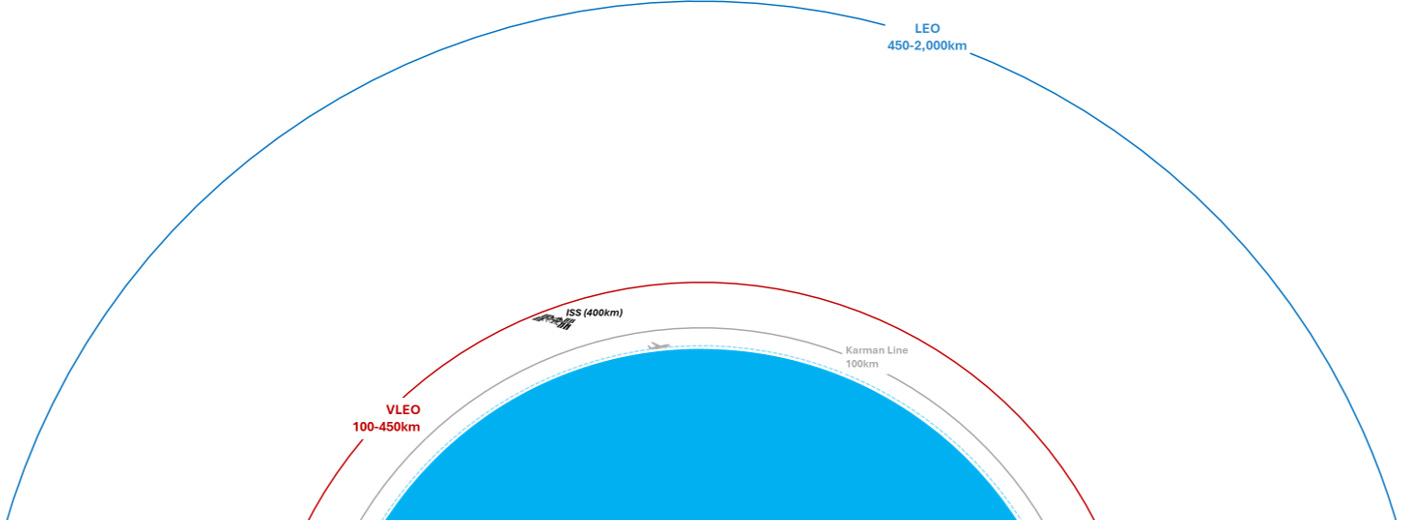

US-based Earth Observation (EO) company Albedo launched their satellite Clarity-1 to VLEO on March 15th, 2025 with an aim to pip the established EO data providers with higher resolution imagery delivered at lower turnaround time. With this development, it would be good to see how far the world has come in mastering this wafery thin region of space between Low Earth Orbit (LEO) and the Kármán line.

The above illustration showcases both the opportunity and challenge of VLEO. Fly low enough and you almost seem to have the best of both the aerial and space worlds. But you also have to deal with the precariousness of operating very close to the edge of space, where all that’s keeping your satellite from burning up in the atmosphere is a single missed station-keeping maneuver. What the eagle-eyed reader can also see in the graphic is that human outposts in space (e.g. ISS, Tiangong) are also in this regime. It clearly is not a matter of novelty, but rarity.

Pains & gains of VLEO

VLEO's primary advantage is simple physics: proximity to Earth. The EU's DISCOVERER program highlights the benefits: sharper imagery, better signal quality, precise positioning, reduced latency, efficient spectrum use, and "self-cleaning" orbits where debris naturally decays.

These benefits come with severe challenges: extreme atmospheric drag requiring continuous propulsion, atomic oxygen degrading materials, and reduced field of view demanding more satellites for equal coverage.

Companies mastering these challenges gain substantial advantages. EOI Space targets 15cm resolution—near classified government capabilities—while Skeyeon, Redwire, Thales and KaleidEO are developing competing technologies for this promising market. For deeper industry insights, see DISCOVERER's Technology Development Roadmap for VLEO Platforms.

A comprehensive read on how the space industry, backed by government and academia are planning to exploit this realm can be found in the DISCOVERER’s Technology Development Roadmap for VLEO Platforms.

Let’s jump off the hype train

Despite marketing hype positioning VLEO as the next frontier, this isn't new territory — it's where space exploration began. Sputnik-1 orbited at 215km, while Mercury, Gemini, and Soviet missions all operated in what we now call 'VLEO.'

Consider that both the ISS and China's Tiangong have maintained stable orbits in this regime for years as continuously inhabited outposts.

These challenges were tackled as early as 1998. The true innovation isn't mastering VLEO physics, which was accomplished decades ago, but creating sustainable business models that transform physical advantages into economic ones. Success will depend not on conquering technical hurdles, but on delivering returns that justify the substantial investment required.

Terminology: ‘Sustained Flight’ in VLEO

A critical distinction for our analysis: unlike higher orbits, VLEO requires continuous active maintenance to exist.

The phrase 'sustained flight' captures the essence of VLEO operations — satellites are actively flying, not just orbiting. Without constant propulsion, a satellite at 250km would reenter within 3-4 months.

To identify true VLEO operators, we look for specific signatures:

Consistent altitude maintenance against atmospheric drag

Non-ballistic trajectory patterns from regular propulsive maneuvers

High-thrust chemical burns or continuous electric propulsion

This framework separates genuine VLEO operators from satellites merely transiting through this region—essential for identifying who has truly mastered this challenging regime.

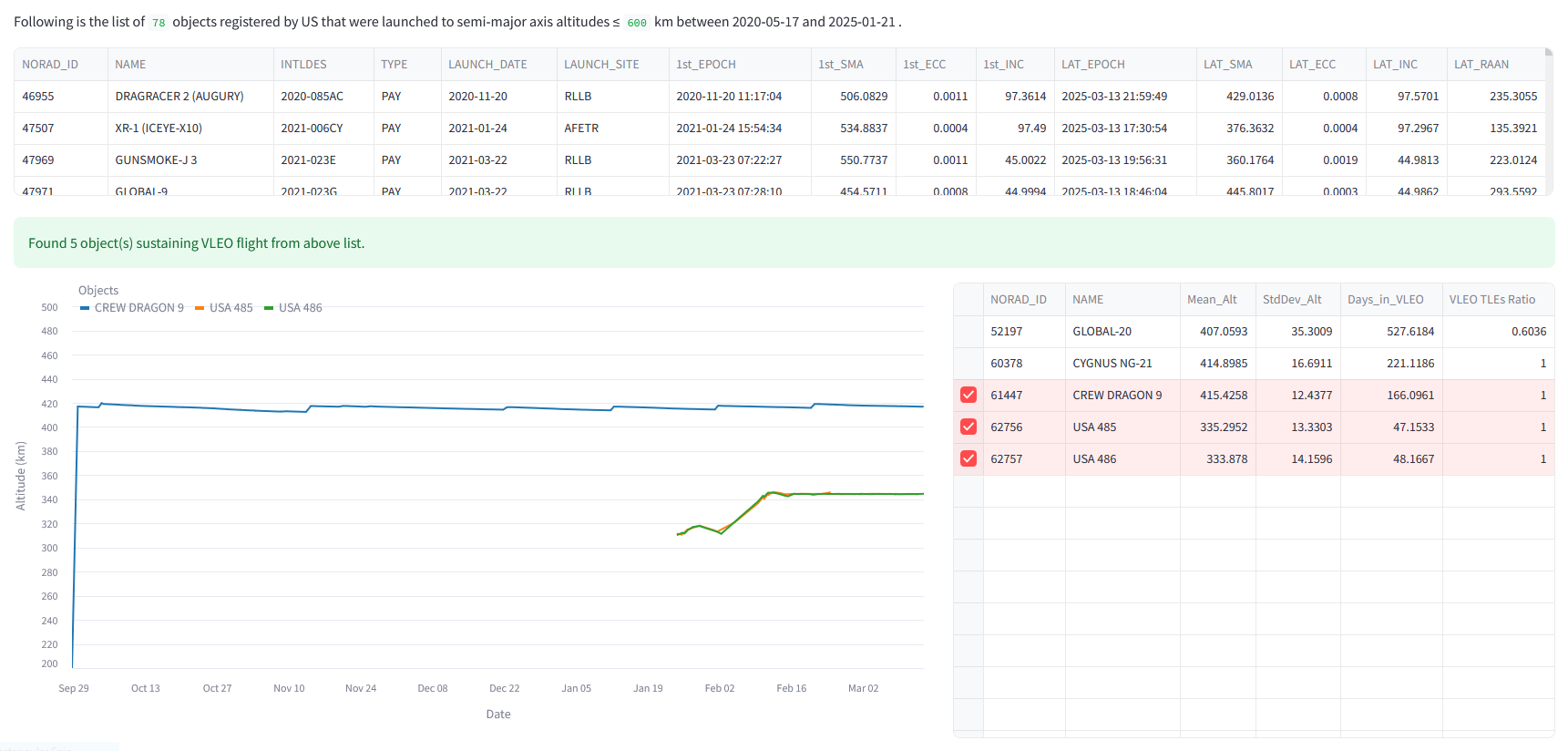

Preliminary analysis: Separating Visitors from Residents

To cut through the marketing claims and identify who is actually mastering VLEO operations, I've analyzed orbital data from January 2020 forward, using custom visualization tools to reveal patterns invisible in standard reporting. For those looking to inspect the data for themselves and verify the inferences made here, you can use the “VLEO Browser”, a custom tool I built leveraging open and public data.

At first glance, the distribution of objects currently in VLEO altitudes (shown below) appears unsurprising — it largely mirrors overall space activity, with the United States, China, and Russia dominating. But this superficial view is misleading, as it includes satellites merely passing through VLEO on their inevitable decay toward reentry.

The real insights emerge when we apply our ‘sustained flight’ criteria to distinguish deliberate VLEO operations from transient objects. My analysis filters for satellites that:

Show consistent altitude maintenance patterns over extended periods

Demonstrate propulsive maneuvers countering natural orbital decay

Maintain altitude stability (measured as 1-sigma dispersion) indicating active control

May have been deployed to higher orbits initially (up to 600km) before deliberately lowering to VLEO

This methodology also identified satellites that might be deliberately obscuring their operational intentions — either by initially hitching rides to orbits with heavier traffic or by executing complex maneuvers to reach their true operational altitude without drawing attention.

What emerges from this more sophisticated analysis is a dramatically different picture of who's actually mastering VLEO operations.

Russia

Recognized VLEO objects attributed to the Russian Federation and their operations reveal a sophisticated, sustained commitment to this challenging orbital regime — and potentially, a military capability few others have demonstrated.

For perspective, note SOYUZ-MS 26 (61043/2024-162A) in the visualization — this is effectively the ISS's altitude profile, as the Soyuz is docked to the Rassvet port. What's remarkable is that Russia is operating multiple satellites well below the ISS in orbits that most operators consider too hostile for sustained operations.

The most aggressive example: COSMOS 2574 (58658/2023-209A), which maintained a precisely controlled 289km orbit in November 2024 — a feat requiring significant propulsion capabilities and advanced materials to withstand atomic oxygen exposure. Even more telling, this satellite appears to be operating in tandem with COSMOS 2575 (58929/2024-026A), launched just six weeks later into the same orbital plane.

The angular separation visualization below reveals a sophisticated orbital dance between these satellites — periods of stable formation flying interspersed with two deliberate rendezvous maneuvers. This coordinated behavior suggests capabilities far beyond simple Earth observation.

Perhaps most impressive is COSMOS 2572 (58435/2023-182A), which has maintained a 300km orbit for 15 consecutive months with a remarkable 1.5km altitude stability (1-sigma dispersion) — precision that would be challenging even in much higher orbits. This follows COSMOS 2568's (56091/2023-045A) sustained operations at an even lower 280km for six months in early 2024.

The common thread? These satellites likely represent deployments of Russia's 4F156 Razdan optical reconnaissance platform — a system operating at altitudes that maximize resolution while demonstrating Russia's mastery of sustained VLEO operations. While commercial players issue press releases about future VLEO capabilities, Russia has quietly built and deploying a sophisticated fleet that is already operating in this regime.

China

China's VLEO operations reveal a dual-track strategy — developing military capabilities while exploring commercial applications.

Using Shenzou-19 spacecraft (just below 400km), China's achievements in extreme low-altitude operations become clear. Their standout performer, Shiyan 25 (57047/2023-087A), has maintained a 270km orbit for over 20 months—approximately 150km below the ISS in an atmosphere 10 times denser.

China has systematically built VLEO expertise across multiple missions. Tianxing-1 maintained ~290km for 8 months in 2022-2023, followed by Tianxing-1 02 (58756/2024-008A) launched to 316km in January 2024. This progression in "space environment detection" capabilities is likely diplomatic cover for reconnaissance or military systems testing.

Their strategy includes paired operations: the uncatalogued OBJECT B (57422/2023-103B), launched one month after Shiyan 25, shows evidence of being a co-orbital partner, performing in-plane maneuvers just 10km higher — suggesting inspection capabilities or technology demonstration.

Commercially, China deployed Haishao-1 in December 2024, an X-band Ultra-Low-Earth-Orbit SAR system in 43° inclination providing sub-meter resolution maritime surveillance. The satellite appears to be conducting incremental testing while descending to operational altitude, strengthening China's maritime domain awareness capabilities.

Most intriguing is automaker Geely's Geesat-3 04 (61014/2024-159D), which has executed complex maneuvers into and out of VLEO, diverging from nine companion satellites launched on the same rocket. While officially part of Geely's connectivity constellation, its unusual behavior suggests either technical problems or, more likely, technology demonstration for dual-use capabilities.

I’ve investigated GeeSat-3 04’s unusual behaviour in a deep-dive, available here:

China's diverse VLEO activities indicate a comprehensive approach to mastering this regime, deliberately blurring lines between military and commercial applications.

United States

The United States presents a fascinating contrast in VLEO operations — publicly showcasing the largest commercial deployment while maintaining a low profile on military applications.

The initial picture is puzzling. Despite the US having the highest total number of objects in VLEO, our filtered analysis (yes, I had to remove everything named ‘Starlink’ just to load all the data) shows surprisingly few sustained operations — just two military satellites plus the reference point of Crew Dragon 9 (docked to the ISS). These two satellites, USA 485 (62756/2025-014X) and USA 486 (62757/2025-014Y), are classified Starshield platforms operated for the National Reconnaissance Office (NRO). Unlike most classified NRO assets in VLEO, these haven't been scrubbed (yet?) from public catalogs, offering a rare glimpse into classified VLEO operations.

The behavior of these Starshield satellites reveals sophisticated capabilities. Deployed alongside 21 commercial Starlinks in January 2025, they quickly diverged from the main group to maintain precise positions at 310km in a 70° inclination orbit. Their coordinated positioning suggests advanced surveillance or reconnaissance functions that exploit VLEO's unique advantages for imaging resolution and signal strength.

These two Starshields have broken away from the pack of 21 Starlink that were deployed from the same Falcon 9 launch in late January this year (2025). For reference into this behavior, prior launches for the NRO were all targeting similar orbits (310km, 70° inclination) and Starlinks sharing those launches went about their own business.

Which brings us to the true VLEO story for the US. It isn't primarily military — it is for commercial purposes, and operating at unprecedented scale:

The VLEO constellation in plain sight

Since June 2024, SpaceX has systematically deployed its V-band Group-10 Starlink v2 mini satellites to VLEO. These satellites — 376 and counting—initially operate at approximately 279km before raising to their operational altitude of ~340km. This represents by far the largest sustained VLEO constellation globally, demonstrating both technical mastery at a scale no other nation or company has attempted.

This massive commercial deployment has profound dual-use implications. While focused on Direct-to-Cell connectivity for consumer markets, the constellation demonstrates capabilities directly applicable to military operations: sustained VLEO flight at scale, mass production of VLEO-capable platforms, and the operational infrastructure to manage hundreds of satellites in this challenging regime. SpaceX has effectively industrialized VLEO operations, creating capabilities that could be rapidly adapted for national security applications.

The US approach reveals a strategic advantage: leveraging commercial investment and innovation to develop dual-use capabilities at a scale that would be difficult to justify through military budgets alone. While Russia and China operate specialized military satellites in VLEO, the US is building a commercial foundation that could support rapid military adaptation if required — following a pattern seen previously with commercial satellite imagery and launch services.

India

India's approach to VLEO demonstrates efficiency — achieving impact with minimal deployments. Though, this can easily be misread without context.

Behind India's 2019 Mission Shakti anti-satellite test lies a sophisticated VLEO spacecraft. Microsat-R, the target satellite, was deliberately maintained at 270km for two months before intercept. Earlier, Microsat-TD sustained operations at 355km for two years — establishing India's VLEO credentials well before Shakti made headlines.

Despite these achievements, India risks falling behind as Russia and China expand their VLEO constellations. This gap requires urgent attention, especially with emerging commercial opportunities.

India's private sector shows promise: KaleidEO developing VLEO imaging through international partnerships, and Bellatrix Aerospace creating indigenous VLEO platforms. However, these efforts need strategic acceleration before the opportunity window closes.

The global landscape evolves rapidly, with the US deploying VLEO Starlinks, Japan demonstrating extreme capabilities with SLATS, and Russia operating Razdan reconnaissance platforms.

Success requires balancing indigenous development with strategic knowledge-sharing. Without this coordinated approach, India risks losing ground as others establish advantages through sustained investment and operational experience.

A discussion point

Despite hundreds of satellites now operating in VLEO, a critical paradox is emerging for companies seeking to enter this orbital regime: the railroad exists, but tickets aren't for sale.

SpaceX has conducted 19 dedicated launches to VLEO, establishing a well-worn path to this valuable orbital real estate. However, their deployment strategy creates fundamental barriers for would-be VLEO operators. Starlink satellites are deployed to ultra-low initial orbits to maximize mass-to-orbit ratios, then raise themselves to operational altitude — a trajectory that serves SpaceX's specific constellation needs but doesn't accommodate traditional rideshare customers.

This accessibility challenge is evident in Albedo's approach with their Clarity-1 satellite. Despite VLEO being their intended destination, they're launching to a 550km Sun-Synchronous Orbit and using onboard propulsion to descend to their operational altitude. This circuitous path carries significant trade-offs: if their propulsion fails, they'll be stuck delivering 17cm resolution imagery instead of their advertised 10cm performance. The alternative — waiting for natural orbital decay — would take years rather than the weeks needed to meet market demands.

The harsh reality is that VLEO access currently depends on specialized vehicles. The true VLEO workhorses — SpaceX's 2-ton Starlink v2 satellites — require Starship for deployment. With Starship's full operational timeline still uncertain, the likelihood of SpaceX offering dedicated VLEO rideshares via Falcon 9 remains extremely low, regardless of commercial demand.

This creates a stark divide in the VLEO market: established players with proprietary launch capabilities (like SpaceX and national space programs) can access VLEO directly, while new entrants must accept compromised orbital insertion strategies or await the maturation of in-orbit servicing technologies. As VLEO's commercial advantages become more apparent, this access disparity may become the primary differentiator between successful and failed VLEO ventures.

So, who was first?

ESA's GOCE (Gravity field and steady-state Ocean Circulation Explorer) set the standard for sustained VLEO operations long before today's commercial entrants. From 2010-2013, it maintained an extraordinary 257km orbit for 24 consecutive months, then pushed even lower to 229km for the final five months of its mission. These achievements from 12 years ago still represent benchmarks that few current VLEO operators — commercial or governmental — have matched in operational duration and precision.

But the absolute altitude record belongs to JAXA's aptly-named Tsubame (SLATS - Super Low Altitude Test Satellite), which earned official recognition from Guinness World Records. This technological marvel progressively lowered its orbit through seven different altitudes, ultimately achieving stable flight at an astonishing 167.4km — nearly half the altitude of the ISS — and maintaining this position for a week. At this extreme altitude, atomic oxygen exposure and atmospheric density create conditions that would destroy conventional satellites within hours. For more on this unique mission, read this (or this, translated to English).

These scientific pioneers demonstrate that VLEO mastery isn't new — it has been achieved repeatedly through specialized engineering. Today's ESA-JAXA collaboration continues with EarthCARE, currently operating at the upper edge of VLEO (~395km) to optimize its active sensing instruments.

The question "who was first?" ultimately misses the point. VLEO has never been virgin territory; it has been systematically explored, exploited, and mastered by science missions for decades. What's new isn't the capability to operate in VLEO, but rather the commercial attempt to transform these hard-won technical achievements into sustainable business models — a challenge that remains unproven despite the marketing hype.

Track VLEO activity as it heats up

This analysis required going beyond datasets and conventional knowledge of space operations. To separate signal from noise in the rapidly evolving VLEO landscape, I developed custom analytical tools that reveal patterns invisible in public reporting.

My freely accessible VLEO Browser offers strategic users a unique lens into this important orbital regime. This purpose-built tool allows you to independently:

Monitor deployments across all major space powers

Identify sustained VLEO operations using filtering algorithms

Track orbital patterns suggesting military applications or technology testing

Detect co-orbital activities and potential rendezvous operations

This resource represents just the beginning. As VLEO deployments accelerate through 2025 and beyond, staying ahead of strategic developments will require continuous analytical refinement and specialized tools beyond what's commercially available. With articles like this one, I aim to provide you with knowledge advantages that conventional sources don’t deliver. To receive more such strategic insights and analyses I publish them, subscribe to Demux'd Thoughts for free.

If you want deeper insights, or to investigate a specific mission or country’s assets in space, reach out: